What is DeFi?

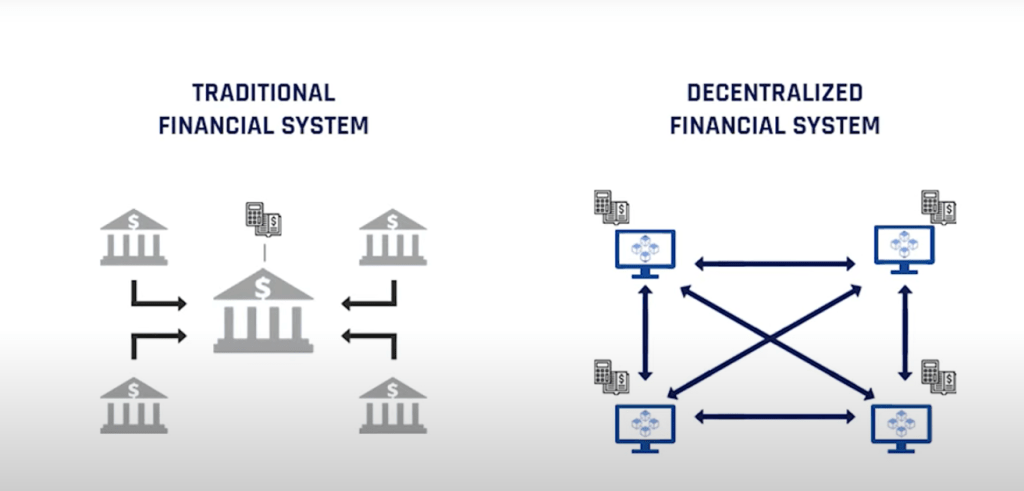

DeFi is an acronym for a longer phrase ‘Decentralized Finance’. Decentralized Finance works under the umbrella term ‘DeFi’ for peer-to-peer financial services. These finance-related services are operated through an open-sourced blockchain, predominantly Ethereum blockchain. Unlike any traditional centralized finance system that works through a governing body among a closed group of people, DeFi operates differently with the same objective.

With DeFi, the users can execute many finance-related activities such as buying cryptocurrency, trading digital assets, earning interest, minting NFTs, swapping crypto pairs, and many more. When any person trade, buy or sell their assets through a DeFi portal, no middlemen are required to complete or perform the transactions. Perhaps, that is why it is the best source of peer-to-peer financial service where the transactions happen directly between two persons.

Since the DeFi is based on the open-sourced blockchain, malicious activities, hacking, and phishing attacks become scanter unlike traditional default activities in the central banking system. Also, there are no centralized authorities to block the payments or deny you access to deeper information. Therefore, decentralized finance holds a great position toward secure, safe, and reliable trading platforms on the internet.

The recent boom in the crypto economy around the world is the result of growing organizations in the decentralized financing (DeFi) sector. Through their real-time service and transparency, users can effortlessly execute transactions that are free from human errors and slow networks. The goal of DeFi is to eliminate all the possible third parties who are usually involved in the financial transaction.

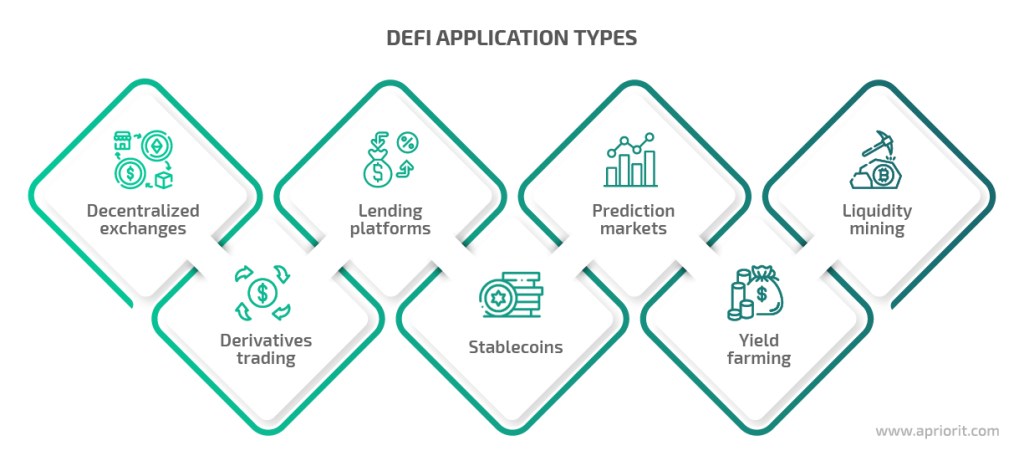

DeFi applications in the crypto market

Most of the decentralized finance applications also known as dApps are built on the world’s second-largest blockchain Ethereum. The Ethereum blockchain uses smart contracts and the transactions are executed automatically when certain conditions of a smart contract are met by both parties. Some of the important applications of decentralized finance are:

- Lending platforms: DeFi applications use smart contracts to lend any user cryptocurrencies from another available user if all the rules and conditions are met. Through such applications, the intermediaries like banks, and centralized financing institutes are replaced. Also, users save a lot of processing charges and service fees which go to banks and lending institutions.

- Decentralized Exchanges (DEXs): Another widely used application based on blockchain where users exchange cryptocurrencies for other cryptocurrencies. Such swapping is also done with U.S. dollars for Bitcoin or Ether. DEX is the most trusted platform where users hold their digital assets without any direct involvement of intermediaries. Some of the popular DEX platforms in the industry are Uniswap(V3), PancakeSwap (V2), DoDo, SushiSwap, and many more.

- Stablecoins: Apart from Bitcoin and Ethereum, many blockchains have been developed to promote stablecoin growth. Stablecoins are cryptocurrencies that are pegged with the country’s fiat currency. Their value always revolves around country-specific fiat currency. These are the digital assets that control the price of other cryptocurrencies if swapped and promote a burning mechanism so that the value of fiat never goes down in the market. Terra is the popular blockchain platform that has USDT and LUNA as its stablecoin.

Also read: Everything you need to know about Terra network and how it works

- Composing new dApps: Decentralized finance (DeFi) applications are open source i.e. the code is open to public verification. This open coding provides the developers with a strong foundation to develop other applications on it. Developers can build new decentralized finance supporting products for the industry.

- Yield Farming: Just like we keep our funds in Fixed Deposit (FD) to yield some returns in the form of interest, yield farming is also a strategic investment in the decentralized finance(DeFi) sector. It demands users stake their cryptocurrencies or tokens to get rewards using transaction fees or interest. According to market experts, yield farming can prove to be volatile and riskier than banks. It requires a good command of strategic thinking and crypto market knowledge to know how the market will drive digital assets values. In 2020, through yield farming, the complete market capitalization of the DeFi sector grew from $500 million to $10 billion.

- Liquidity Mining: It is another process for crypto holders to earn rewards and fees by lending their digital assets to decentralized exchanges (DEX). The DEX platforms in return provide the crypto holders with some sort of rewards and fees in the form of either native cryptocurrency or trading fees. However, mining, farming, and investing are subjected to market risks and can even cause a state of Impermanent Loss (IL) to the holder or investor.

How DeFi is better than the traditional banking system?

Through decentralized finance applications people gain full access and control over their digital assets via digital ledgers. They also get full authority to access their financial data while making a global transaction. As it does not involve financial bureaucrats, it becomes easy for people to make decisions for their assets on the DeFi platform.

Developers from multiple domains and sectors can use the open-source code of DeFi platforms to build unique finance-related products. They can even experiment with smart contracts on a beta test scale to meet good results. The financial instruments will eventually evolve around decentralized finance as the market continues to grow bigger. Also, developers can work with free minds without micromanaging superior authority in the system. Such kinds of financial products and tools will be capable of smoother operations of digital assets without any hindrance.

Today people need a more clear, open, and transparent form of financial services. It is beyond our doubt that these requirements have led to significant growth in multiple financing sectors. Decentralized finance or DeFi is one of the creations to battle against the twisted and tangled banking systems. Nowadays, people find DeFi more convenient and trouble-free to use for their transactions. However, still, the decentralized finance sector calls for more robust data privacy and security feature with growing malicious activities on the internet.

Also read: Everything you need to know about Terra network and how it works